China Looks to Saudi Arabia Amid Shifting Sands in U.S. Economic Ties

By Zhang Erchi, Wang Zili and Denise Jia

As tensions between China and the U.S. show no signs of abating, ensnaring businesses from both countries in a seemingly endless spiral of restrictions and trade curbs, Beijing is looking elsewhere to find opportunities to bolster economic growth and expand its influence in key regions with geopolitical significance.

The most recent example is Saudi Arabia, the world’s second largest oil producer, where a flurry of political and business exchanges in the past six months represents China’s highest-level diplomatic engagement with Arab nations since the founding of the People’s Republic of China in 1949.

In December, Chinese President Xi Jinping made a state visit to Saudi and met with nearly 20 Arab leaders who attended the China-Arab States Summit and the China-Gulf Cooperation Council (GCC) Summit in Riyadh.

During his meeting with King Salman bin Abdulaziz Al Saud, Xi said that China sees Saudi as an important force in the multi-polar world and attaches great importance to developing stronger ties.

The business community should match those aspirations set forth by the leaders of those two countries, Saleh Khabti, a Saudi deputy minister for investment who previously lived in China for over 13 years, told Caixin in an interview in June.

More recently, Xi’s visit was followed up by the 10th Arab-China Business Conference held last month in the Saudi capital, where more than 30 deals worth about $10 billion were signed covering industries including technology, renewables, real estate, minerals, supply chains, tourism and health care.

As economic ties fray with the U.S., Beijing is increasingly turning to Saudi Arabia to boost trade relations that are already strong. Saudi remains China’s top oil supplier and has been its largest trading partner in the Middle East since 2001.Last year, trade of goods between the two countries increased 32.9% to $116 billion, according to China’s Ministry of Foreign Affairs.

That is still dwarfed by the almost $700 billion in total trade in goods last year with the U.S., China’s largest trading partner.

Since the oil boom in the 1970s, Saudi Arabia has become an important player in the modern global political and economic system, a fact not lost on Beijing. This status was bolstered further by joining international multilateral mechanisms such as the G20 in 2008 and the World Trade Organization in 2005.

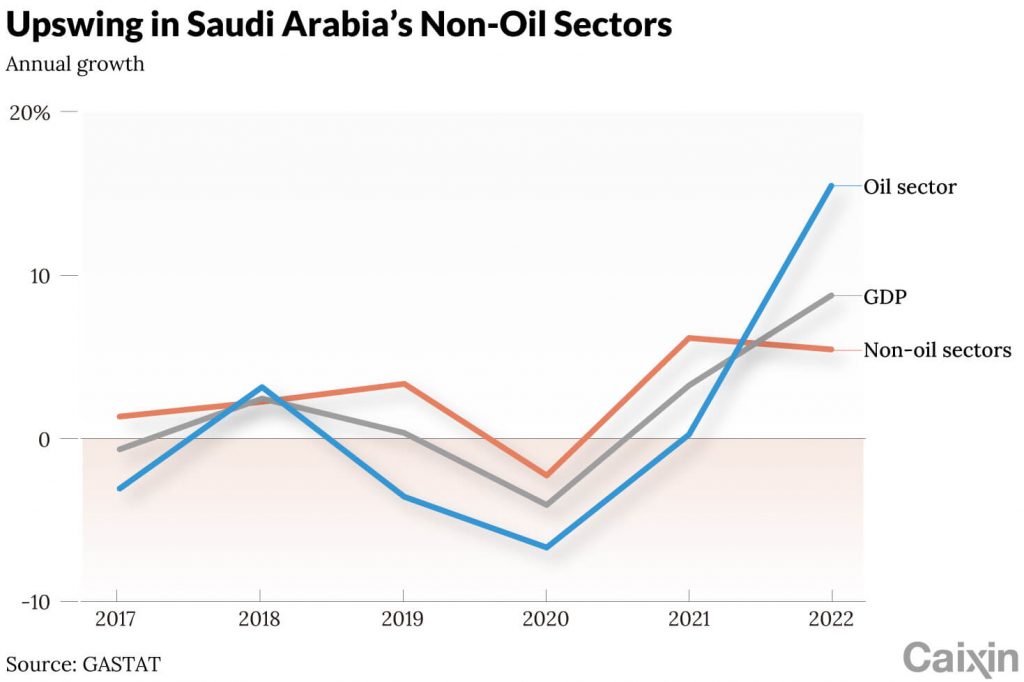

The Saudi Vision 2030, a strategic framework announced in 2016 to reduce its dependence on oil, diversify its economy, and develop public service sectors, along with social changes including increased freedoms for women and eased restrictions on mandatory religious practices has further boosted its appeal as a place to do business.

These changes have factored into China’s shift in focus on the kingdom, which accounts for 12% of world oil production, second only to the U.S. However, this isn’t a one-sided affair. China, the world’s second largest consumer of oil – after the U.S. – has seen its embrace of Saudi Arabia reciprocated.

‘Trusted partner’

“If you want a trusted partner in the world — one of the best partners in the world — it’s the People’s Republic of China,” Mohammad Abunayyan, chairman of Saudi renewable energy company ACWA Power, declared at the Arab-China business conference last month.

Prince Abdulaziz bin Salman, Saudi’s energy minister, said at the conference that cooperation with China can help the implementation of the Saudi Vision 2030 as it is a big buyer of Saudi oil and chemical products, and a global leader in new energy, which can help Saudi to develop new energy industries.

Indeed the $10 billion in signed deals included a $5.6 billion agreement between the Saudi investment ministry and Chinese electric-vehicle maker Human Horizons to create a joint venture for research, manufacturing and sales.

One key factor in the appeal of the Middle Eastern country for Chinese companies is that it doesn’t follow the U.S. in cracking down on Chinese firms and instead shows them greater goodwill at both the government and public levels, representatives at some Chinese companies told Caixin.

“When we introduced ourselves as Chinese, all the locals welcomed us with special enthusiasm,” said Zhang Menghan, president of Chinese venture capital firm Hexuan Capital, who visited Saudi for the first time in June.

This is in contrast to the reception from the U.S. government, which in recent years, has increasingly imposed restrictions viewed as an attempt to slow China’s technological advancement. That has included export controls on critical manufacturing equipment to China’s semiconductor industry.

The U.S. has also long blocked foreign investment at home in sensitive high-tech areas through implementation of increasingly stringent regulations set by the Committee on Foreign Investment in the United States. This has pushed Chinese tech companies to ramp up efforts to seek non-U.S. investment and other markets.

This puts Saudi Arabia in a prime position, given the kingdom’s proximity to Europe and Africa. Some Chinese investors are looking to set up production bases for higher value-added goods using raw materials and other resources from the kingdom, Africa, and other regions, and exporting the finished goods, said Saudi deputy minister for investment Khabti.

In a research report, Chinese solar wafer maker TCL Zhonghuan Renewable Energy Technology Co. Ltd., which announced it is partnering with Saudi Arabian clean energy developer Vision Industries to construct a solar wafer factory, revealed the main reasons for building its Saudi plant: abundant solar resources and its geographical location, which creates the potential of selling solar power to northern Europe and North Africa.

“The unique location will allow the Chinese companies to have a second base to serve other markets,” said deputy minister Saleh Khabti.

The uptick in business and political links come at time of shifting sands in both countries.

Both China and Saudi Arabia are experiencing dramatic economic and social changes, and there are common interests, Abdullah Alkowaileet, executive director of the Saudi Center for Research and Knowledge Intercommunication, told Caixin.

Four years ago, shopping malls and restaurants in the Islamic country had to suspend business during prayer, which Muslims do five times a day, while women had to dine in separate areas, Huang Xiaochuan, Saudi manager of Alibaba Cloud, a unit of Chinese e-commerce giant Alibaba, told Caixin.

Today these restrictions are no longer in place in Riyadh, where women are now free to go to restaurants and cafes, play tennis, go bowling, watch movies in theaters, and stores can remain open during prayer, said Huang.

“We used to joke about Riyadh being the world’s most boring city,” Mark C. Thompson, a British academic who has lived in Saudi Arabia for more than 20 years, recently told Caixin, “Now it’s this vibrant capital city, exciting, and so much happening.”

These changes have been pronounced and sudden.

In just four years since Alibaba’s Huang made his first business trip to Saudi Arabia in 2019, he has witnessed the country’s economic opening and dramatic social changes.

“The changes have been building up for many years,” Thompson said.

China meanwhile is facing challenges of its own. Last year saw the second slowest GDP growth in four decades and its economy continues to struggle to recover from the effects of the pandemic. In addition, policymakers are scrambling to deal with record high youth unemployment, a plunging birthrate not seen since the 1960s and a rapidly aging population.

This awakening to the social and business changes has been mutual.

Saudis didn’t know much about China about 10 years ago, but that started changing four or five years ago, Yahya Mahmoud bin Junaid , president of the Saudi Center for Research and Intercommunication Knowledge, told Caixin. Now out of every 20 cars on the street, maybe five or six are Chinese made, he said.

Non-Western view

More importantly, Saudis are beginning to realize that China is not the country portrayed in the Western media.

Saudis see China as a global actor from who there is much to gain, especially economically, but increasingly also in other non-economic spheres, Robert Mogielnicki, senior resident scholar at the Arab Gulf States Institute in Washington, told Caixin.

Since Xi’s visit, Chinese companies have accelerated their investment in Saudi. Chinese theme park operator Haichang Ocean Park signed a memorandum of understanding with the Saudi’s Ministry of Investment in April to develop the country’s first ocean park.

In May, China’s biggest steelmaker Baoshan Iron and Steel Co. signed an agreement with Saudi Aramco and Public Investment Fund to build a steel plate manufacturing joint venture.

Last month, Chinese genetic-research company BGI Group announced a deal with Saudi healthcare company Tibbiyah Holding to build a cutting-edge genomic clinical lab in Saudi.

These partnerships are in stark contrast to the first batch of Chinese enterprises that came to Saudi more than a decade ago, when they were mostly related to infrastructure.

Up to now, engineering contracting has been the area that has seen the most cooperation between China and Saudi, according to the China International Contractors Association.

As of the end of 2019, a total of 158 Chinese companies had registered with the Economic and Commercial Office of the Chinese Embassy in Saudi, with engineering firms accounting for more than 80%. These include large state-owned enterprises such as China Railway Construction Corp., Power Construction Corp. of China, China Communications Construction Co. Ltd., and China Energy Construction Group Co. Ltd.

Since 2014, Chinese Internet companies have begun to expand into the United Arab Emirates (UAE), which is the most globalized country in the Middle East, according to the DHL Global Connectedness Index 2022 conducted by DHL and New York University’s Stern School of Business.

Yalla, a Chinese-owned social media network based in Dubai, has become wildly popular in the Middle East, with its CEO Yang Tao previously having worked for Chinese telecommunications equipment company ZTE in Abu Dhabi.

Elsewhere, former Huawei executive Rita Huang founded Dubai-based delivery company Imile. And TikTok, owned by Chinese tech juggernaut ByteDance, started its Middle East business from Dubai and has expanded to Saudi.

Chinese companies such as pharmaceutical technology firm XtalPi Inc. also see potential in Saudi. The company is exploring markets outside pharmaceuticals and came to Saudi in hopes to explore collaboration with local energy giants such as Aramco and SABIC, XtalPi Chief Financial Officer Tan Wenkang said.

As an investor in XtalPi, Hexuan’s Zhang said in June the companies most suited to come to Saudi are those that can combine their products and services with the country’s energy and chemical industries as Saudi lacks a complete industrial chain, unlike in China.

Local knowledge

Many Chinese companies operating in Saudi enter the market as joint ventures.

Setting up local joint ventures can help Chinese firms to get government licenses in regulated industries and quickly expand their business. This form of partnership reflects the relatively closed nature of the Saudi market and the high barriers for foreign companies in adapting to the local social and cultural environment and national policies, said Zou Zhiqiang, a researcher at the Center for Middle East Studies at Fudan University.

For example, Chinese artificial intelligence (AI) leader SenseTime in November set up a joint venture with Saudi’s Public Investment Fund (PIF) to deliver AI-powered solutions across the Middle East and Africa region. Meanwhile, Chinese delivery giant SF Express has a joint venture with local firm Ajlan & Bros Holding Group.

Another typical example is Alibaba Cloud. The Chinese cloud giant’s joint venture with Saudi Telecom Company Group launched two data centers in Riyadh last year. Alibaba provides technology platforms, products and operational support, while Saudi Telecom provides facilities and transmission resources.

“Locals better understand the needs of their own country’s customers, are more familiar with and understand local business logic and culture, and Alibaba Cloud can get its business on the ground faster by forming joint ventures with local partners,” Alibaba Cloud Saudi manager Huang said.

But Saudi is not as flush with wealth from so-called “black gold” as many people think. The government’s cash flow has been stretched somewhat by the construction of major projects under the ambitious Saudi Vision 2030 plan. Some Chinese engineering companies are worried that an oil price plunge could hit its infrastructure market hard.

This requires Chinese companies to be prudent in selecting projects in Saudi, said Fudan University’s Zou. Companies should pick the most promising areas of development, such as new energy and AI, he suggested. Even if the Saudi government’s future financial difficulties put the brakes on some areas, these higher priority projects may still be preserved, he said.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Osama – stock.adobe.com