What’s Behind China’s ‘Missing’ Foreign Exchange Reserves

By Li Zongguang

Data released last week show a notable discrepancy between China’s trade surplus and foreign exchange reserves.

In the first quarter, China’s cumulative trade surplus reached $204.7 billion, a year-on-year increase of over 33%. However, during the same period, foreign exchange reserves only grew by around $55 billion, leaving a gap of about $150 billion.

The reality is that the mismatch between the trade surplus and the growth of foreign exchange reserves has been there for a while. At the beginning of the year, similar discussions had gotten traction online, with the focus of the social media debate centered around the question: “Over the past three years, China’s merchandise trade surplus has totaled nearly $2 trillion, but during the same period, foreign exchange reserves have barely changed. Where did the over $2 trillion in foreign exchange reserves go?”

The answer is complex and we will break it down item by item. Regarding the source of my data, the information is primarily drawn from foreign exchange reserve data and China’s “Balance of Payments” report released by China’s central bank.

Companies holding more dollar

First, we need to clarify a key concept. China’s foreign exchange reserves are foreign currency assets directly held by the central bank. When an exporting company receives a foreign exchange payment, it’s recorded in export trade. But the foreign exchange reserves will not increase automatically if the exporter does not convert the foreign exchange into yuan. Similarly, if an importer pays with U.S. dollar in their own bank account, the state’s foreign exchange reserves will not decrease.

In recent years, although China’s trade surplus has continued to hit new highs, the growth of the trade settlement and sales balance have been relatively stable, with the gap between the two continuously widening.

From 2020 to 2022, the net balance of goods trade settlement totaled approximately $820 billion. This means that out of the $2 trillion goods trade surplus, about $1.2 trillion was retained by export companies, holding overseas in their own hands. That accounts for nearly 60% of the “missing foreign exchange reserve gap.”

No more mandatory settlement

So why do Chinese traders choose to hold such a large amount of foreign exchange? This requires a closer look at China’s rather unique foreign exchange system.

Before 2012, China implemented a mandatory settlement and sale system, whereby residents’ foreign exchange income had to be sold to state-designated financial institutions and deposited into the central bank’s foreign exchange reserve account, with the state providing an equivalent amount of yuan to the individual or company. Then, when enterprises used foreign exchange, they would buy the equivalent amount of foreign exchange with yuan from state-designated financial institutions.

Under this system, residents had no autonomy in retaining foreign exchange. Therefore, before 2012 the settlement and sales balance and the merchandise trade balance were basically consistent.

This mandatory system began in the 1990s. At that time, China’s foreign exchange reserves were extremely scarce. To cope with external risks and protect the safety of the national financial system, the mandatory settlement system was imposed — foreign exchange earned through trade surpluses was a valuable resource that had to be concentrated in the hands of the state.

However, since joining the WTO in 2001, China’s economy entered a period of rapid expansion, with soaring foreign trade exports and a strong expectation of yuan appreciation, which led to the continuous inflow of hot money.

A massive trade surplus combined with sustained net capital inflows caused China’s foreign exchange reserves to increase rapidly in the short term. Particularly since 2007, foreign exchange reserves have increased by more than $400 billion annually. By 2011, China’s foreign exchange reserves rapidly exceeded $3 trillion.

The rapid growth of foreign exchange reserves led to the passive expansion of the base currency, exacerbating the overheating of the economy. Foreign exchange reserves have turned from a valuable asset into somewhat a burden.

Under this context, the Chinese state gradually relaxed its control over the mandatory settlement and sale system since 2008. In 2012, the State Administration of Foreign Exchange officially announced the end of the mandatory system. Since then, enterprises have been able to retain their export earnings based on their own needs, without being limited by quotas.

Enterprise’s willingness to settle foreign exchange is influenced by multiple factors. Over the past three years, the following factors may have suppressed their willingness to settle:

• Exchange rate fluctuation. When the yuan appreciates, Chinese enterprises tend to settle more foreign exchange; conversely, during periods of yuan depreciation, they tend to retain their dollars.

From the second half of 2021 to 2022, factors such as the aggressive interest rate hikes by the U.S. Federal Reserve led to a significant increase in U.S. dollar value. Although the yuan has been strong in the past three years, it has experienced a wave of depreciation against the U.S. dollar. Under depreciation expectations, enterprises tend to retain a certain amount of dollars to reduce currency exchange risk.

• Tightening oversight. Regulatory supervision of the market is constantly strengthening as the market matures. In recent years, to prevent disorderly capital outflows and maintain stable operation of the foreign exchange market, the Chinese central bank has continuously improved the micro-supervision of the foreign exchange market, including crackdowns on illegal activities. In some circumstances, it also affected the convenience of currency exchange for companies. Chinese enterprises tend to hold a higher proportion of foreign exchange to reduce the trouble of settlement.

• Geopolitical tensions. Trade wars and pandemics have led to increased uncertainty in supply chains. With higher uncertainty, enterprises have become more cautious and increased the proportion of precautionary foreign exchange retention.

• Market development. In recent years, the rapid development and improvement of the offshore yuan market have provided enterprises with a variety of foreign exchange management options. In the past, obtaining foreign exchange could only be done through the central bank, but now enterprises can buy or sell foreign exchange directly through financial institutions. It reflects the internationalization of the yuan and is an outcome encouraged and welcomed by the central bank.

Two sources of deficit: service trade and investment

Although China has a regular surplus in goods trade, which is an important source of foreign exchange income, both service trade and investment income are in regular deficits, which will lead to a reduction in foreign exchange reserves.

Services trade includes categories such as tourism, finance, and cultural entertainment. In China’s case, the trade deficit mainly comes from tourism and the cost of intellectual property rights.

Taking 2022 as an example, according to the Ministry of Commerce data, travel contributes most to the deficit at over $100 billion. In recent years, the tourism service deficit is narrowing due to Covid, while the intellectual property usage deficit is still expanding.

As a result of the pandemic, China’s tourism service deficit has rapidly narrowed, from around -$250 billion to about -$100 billion. Regarding intellectual property, due to China’s current role in the global trade division, which still focuses on mid and low-end manufacturing with a relatively low proportion of independent intellectual property rights, China’s intellectual property payment deficit continues to expand.

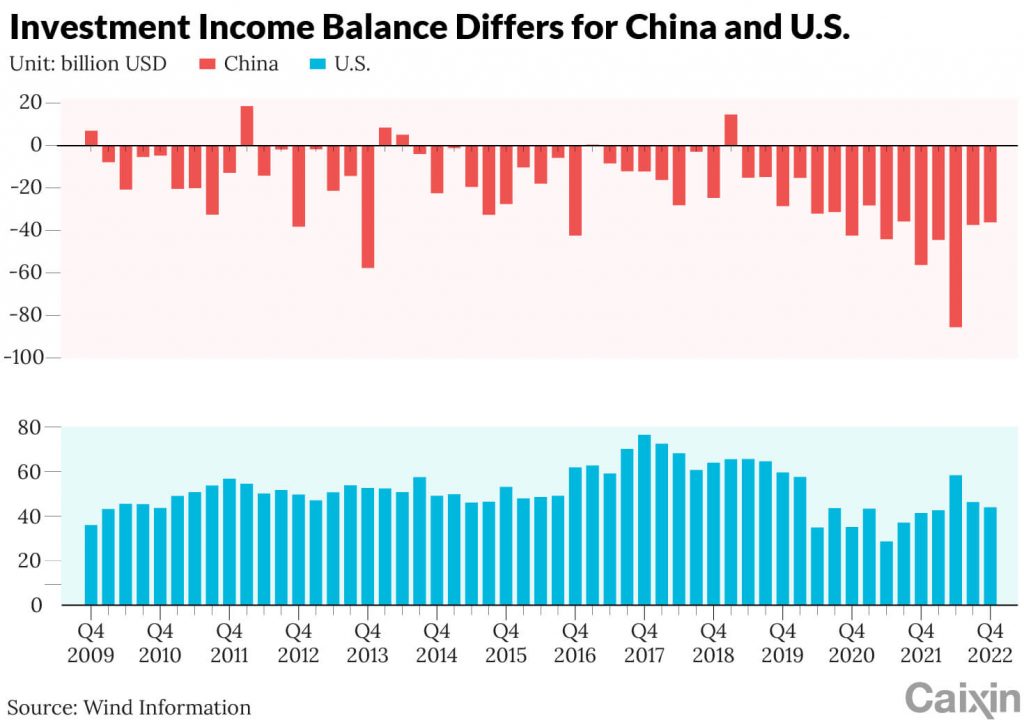

Investment Income — China vs. U.S.

China has a net investment of more than $2 trillion abroad, but its investment income is negative year after year. In stark contrast, the United States, the largest net borrower, has a positive investment income year after year.

This is mainly because China’s foreign investment is mainly reserve asset investment. For higher stability, it focuses on the purchase of low-risk bonds. Meanwhile, foreign capital coming to China is mainly direct foreign investment. Therefore, the cost of utilizing foreign capital (FDI) is much higher than the return on foreign investment (buying U.S. treasury bonds). That’s why we see a negative investment income difference.

Over the past three years, the investment income deficit has accumulated to $487 billion. Overall, from 2020 to 2022, China’s services trade and investment income deficits exceeded $830 billion. The settlement is again smaller than the actual trade. There was a -$370 billion gap after foreign exchange settlement and sale.

Money in private hands

The trade balance, labor income, and investment income mentioned above are regular items in the balance of international payments and are classified as current account items. The current account in China is convertible, meaning that related international payments and transfers are not restricted.

Meanwhile, in China, capital and financial account items are not fully convertible.

Capital account items include international capital transfers and acquisitions and disposals of other non-financial assets; financial account items include international investment situations, such as direct investment, securities investment, and trade credit, deposits, and loans.

Currently, China has basically realized convertibility for corporate direct investment, but many projects are still subject to strict restrictions. For example, domestic individuals still cannot directly participate in overseas property purchases or securities investments.

These years, restrictions on cross-border investment and financing are relatively relaxed, and related fund exchanges are very active.

According to research by the China Foreign Exchange Center, from 2020 to 2022, China absorbed more than $1 trillion in cross-border investment and financing — that’s the in-flow. At the same time, China’s foreign capital utilization totaled close to $2 trillion — that’s the outflow — with the scale of private sector foreign investment accounting for more than 80%. This means that our net investment and financing expenditure is about $400 billion in the outflow. However, if we take a look at what’s recorded in the financial account settlement and sales, the difference between the two during 2020-2022 is a net inflow of $100 billion.

Why the discrepancy? This indicates that a large part of foreign investment was paid by the “private” U.S. dollar held by Chinese companies and individuals, which is consistent with the generally accepted estimate based on the saying that “80% of China’s foreign investment comes from the private sector.”

Moreover, due to reasons such as statistical discrepancies, corporate misreporting, and capital flight, there is an unexplained portion in the central bank’s international balance of payments.

Changes in reserve asset valuation

Finally, exchange rates fluctuate. A significant portion of China’s foreign exchange reserves are non-U.S. dollar assets, but foreign exchange reserves are reported in U.S. dollars. Since this year, affected by the accelerated pace of the Fed’s balance sheet reduction and policy tightening, the U.S. dollar index has appreciated significantly by nearly 7% in the past three years.

Foreign exchange reserves are mainly composed of low-risk bonds. Since 2021, the intensity of overseas interest rate hikes, especially in the U.S., has been unprecedented. The yield on the U.S. 10-year Treasury bond has risen from the low of 0.5% in 2020 to 4.3% in 2022.

As bond values are inversely proportional to maturity yields, bond values in various countries have experienced significant depreciation. Among them, the Bloomberg Dollar Bond Index fell by 8.29% between 2020 and 2022. The European bond market has seen an even more dramatic decline. The Bloomberg Euro Aggregate Index fell nearly 17%. Considering the large bond positions held by China, the decline in related asset prices will also lead to a decrease in the U.S. dollar valuation of foreign exchange reserves.

Considering the sensitivity of the foreign exchange reserve composition, we cannot further break down the estimates in detail. However, a rough estimate shows that in the past few years, the impact of large-scale asset price fluctuations on foreign exchange reserves has been in the range of tens, even hundreds, of billions of dollars

Where has the foreign exchange gone?

To sum up, taking into account various factors, the “missing” $2 trillion in China’s foreign exchange reserves can be explained by the following components:

• Companies’ foreign exchange retention: about $1.2 trillion

• Services and investment deficit: $0.37 trillion

• Capital account surplus: -$0.1 trillion

• Errors and omissions: $0.35 trillion

• Interest rate hike cycle, foreign exchange reserve “valuation loss”: $0.05-0.2 trillion (rough estimate)

The total impact of these factors is about $2 trillion, which basically explains the relationship between China’s trade surplus and the increase in foreign exchange reserves in recent years.

We should recognize that the “missing” foreign exchange reserves are mostly retained by the private sector and import and export businesses. It reflects that wealth is being held increasingly by the people, not the state. At the same time, it is also an indication of the internationalization and increased competitiveness of the yuan. It’s a good sign.

Read also the original story.

caixinglobal.com is the English-language online news portal of Chinese financial and business news media group Caixin. Global Neighbours is authorized to reprint this article.

Image: Katvic – stock.adobe.com